News

Maximise Your Retirement Savings

2025 Contribution Cap Changes Explained

Changes to Contribution Caps for the 2025 Financial Year

As we prepare for the 2025 financial year, significant changes are underway in the domain of superannuation contribution caps. Superannuation, a cornerstone of retirement planning for millions of Australians, offers a tax-effective means of saving for the future, with contribution caps dictating the maximum allowable annual contributions to super funds while still enjoying tax benefits. The key adjustments to these caps for the upcoming financial year are as follows:

Understanding Superannuation Contribution Caps

Superannuation contribution caps establish the maximum amount individuals can contribute annually to their super funds while still benefiting from concessional tax treatment. These caps undergo periodic adjustments based on factors like inflation and economic conditions.

There are two primary types of superannuation contributions:

- Concessional Contributions: These encompass employer contributions (e.g., employer super guarantee contributions and salary sacrifice contributions) and personal contributions claimed as tax deductions. Concessional contributions are taxed at a concessional rate of 15% within the super fund.

- Non-Concessional Contributions: These are after-tax contributions made by individuals from their take-home pay or savings. Non-concessional contributions are not taxed within the super fund, as they have already been taxed at the individual’s marginal tax rate.

Changes in Contribution Caps for 2025

For the 2025 financial year, adjustments have been made to both concessional and non-concessional contribution caps:

- Concessional Contribution Caps: The concessional contribution cap is set to increase from the previous financial year. Individuals will be able to contribute more money to their superannuation funds while enjoying concessional tax treatment. The new concessional contribution cap for the 2025 financial year will increase from $27,500 to $30,000.

- Non-Concessional Contribution Caps: Similarly, the non-concessional contribution cap may also see adjustments for the 2025 financial year. Non-concessional contributions allow individuals to boost their retirement savings beyond the limits of concessional contributions. The new non-concessional contribution cap for the 2025 financial year will increase from $110,000 to $120,000.

Implications for Retirement Planning

These changes in superannuation contribution caps have significant implications for retirement planning strategies. Individuals should review their contribution plans with one of our advisers and adjust them accordingly to take advantage of the increased caps, going forward.

Maximizing contributions within the caps can help individuals bolster their retirement savings and ensure a more financially secure future. Seeking professional financial advice to tailor superannuation strategies to specific circumstances and retirement goals is advisable.

Also, given the proposed reductions in tax rates for the 2025 financial year, there is a potential to obtain a larger tax saving by making non-concessional contributions this financial year, rather than waiting until the new financial year.

Worked Example.

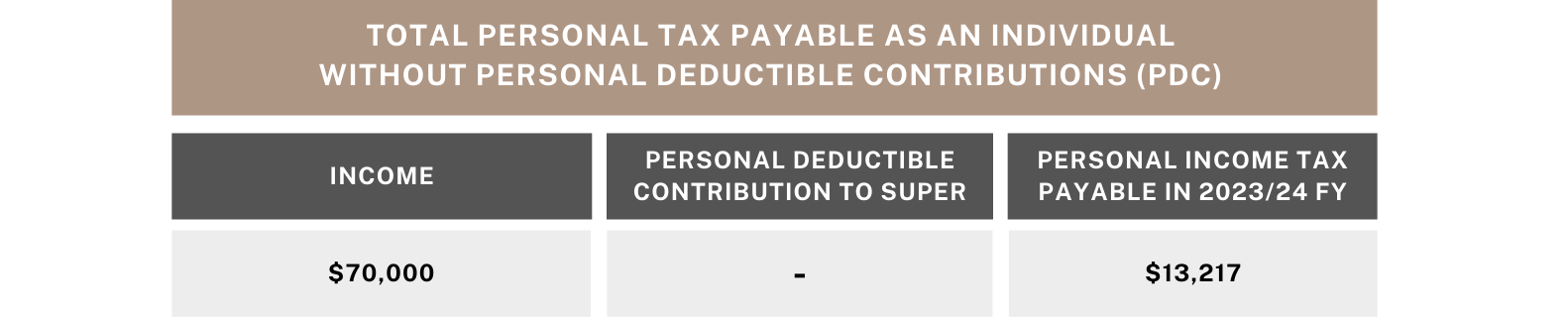

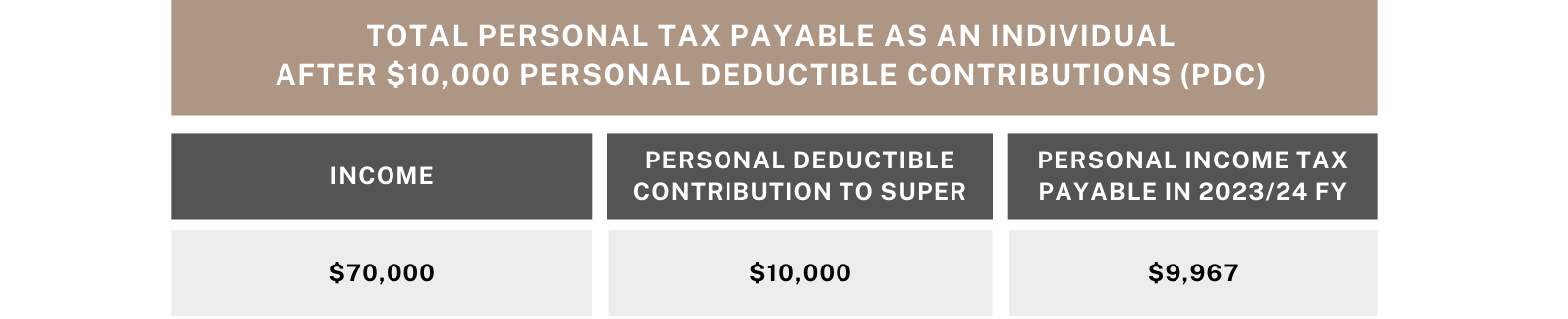

The following provides a comparison of tax savings for someone earning $70,000 per annum and the positive tax impact of making an additional $10,000 NCC to super as a Personal Deductible contribution:

As you can see, the after tax benefit for making this type of contribution is approximately $1,750 as per the table below.

Conclusion

As the 2025 financial year approaches, please ask our financial advisers about the new superannuation contribution limits to optimize your retirement savings strategies. Understanding the adjustments to concessional and non-concessional caps is crucial for making informed decisions about super contributions and ensuring alignment with your retirement objectives. By staying informed and proactive, our clients can leverage the tax benefits of superannuation to secure a comfortable and financially stable retirement.

Warning: All information in this article is general and not personalised.

As you can see, the after tax benefit for making this type of contribution is approximately $1,750 as per the table below.

Conclusion

As the 2025 financial year approaches, please ask our financial advisers about the new superannuation contribution limits to optimize your retirement savings strategies. Understanding the adjustments to concessional and non-concessional caps is crucial for making informed decisions about super contributions and ensuring alignment with your retirement objectives. By staying informed and proactive, our clients can leverage the tax benefits of superannuation to secure a comfortable and financially stable retirement.

Warning: All information in this article is general and not personalised.